Find the best suited Mutual Fund & FDR

From 10+ insurance companies

MUTUAL FUNDS:

A Mutual funds let you pool your money with other investors to “mutually” buy stocks, bonds, and other investments. Mutual funds are managed by professional fund managers who make investment decisions on behalf of the investors.

Types of Mutual Fund Investment Methods

A) Systematic Investment Plan (SIP)

SIP allows you to invest a fixed amount periodically (monthly, quarterly, etc.), making it a disciplined way to invest.

- Features:

- Minimum investment starts as low as ₹1000.

- Reduces market timing risk (uses Rupee Cost Averaging).

- Suitable for salaried individuals and long-term goals.

- Encourages financial discipline.

- Advantages:

- Small regular investments are easy to manage.

- Overcomes market volatility.

- Benefits from compounding if investments are held long-term

B) Lumpsum Investment

Investing a large, one-time amount in a mutual fund scheme.

- Features:

- Best suited for investors with surplus funds.

- Works well when markets are undervalued or during corrections.

- High potential for growth over the long term.

- Advantages:

- Ideal for long-term wealth creation.

- Easy to manage since it’s a one-time investment.

- Suitable for goal-based investing (e.g., child’s education, buying a house)

C) Tax-Saving Mutual Funds (ELSS)

A type of mutual fund offering tax benefits under Section 80C of the Income Tax Act.

- Features

- Lock-in Period: 3 years (shortest among tax-saving options).

- Equity Exposure: Invests primarily in equities (higher growth potential).

- Tax Benefits:

- Investments up to ₹1.5 lakh per year are eligible for tax deduction under Section 80C.

- Returns are taxed as Long-Term Capital Gains

- Advantages of ELSS:

- Tax Savings: Reduces taxable income.

- High Growth Potential: Beign equity-based, returns can be higher compared to other 80C options (e.g., PPF or NSC).

- Short Lock-in: Only 3 years compared o 5-15 years for other 80C investments.

- Flexibility: Option to invest via SIP or lumpsum.

How to Choose between SIP, Lumpsum, and Tax-Saving Mutual Funds

- SIP: Ideal for beginners, salaried individuals, and those looking for a disciplined approach.

- Lumpsum: Best for those with surplus funds and long-term goals.

- Tax-Saving Funds (ELSS): Best for combining tax benefits with equity-based growth.

Advantages of ELSS:

- Tax Savings: Reduces taxable income.

- High Growth Potential: Being equity-based, returns can be higher compared to other 80C options (e.g., PPF or NSC).

- Short Lock-in: Only 3 years compared to 5-15 years for other 80C investments.

- Flexibility: Option to invest via SIP or lumpsum.

How to Choose between SIP, Lumpsum, and Tax-Saving Mutual Funds

- SIP: Ideal for beginners, salaried individuals, and those looking for a disciplined approach.

- Lumpsum: Best for those with surplus funds and long-term goals.

- Tax-Saving Funds (ELSS): Best for combining tax benefits with equity-based growth.

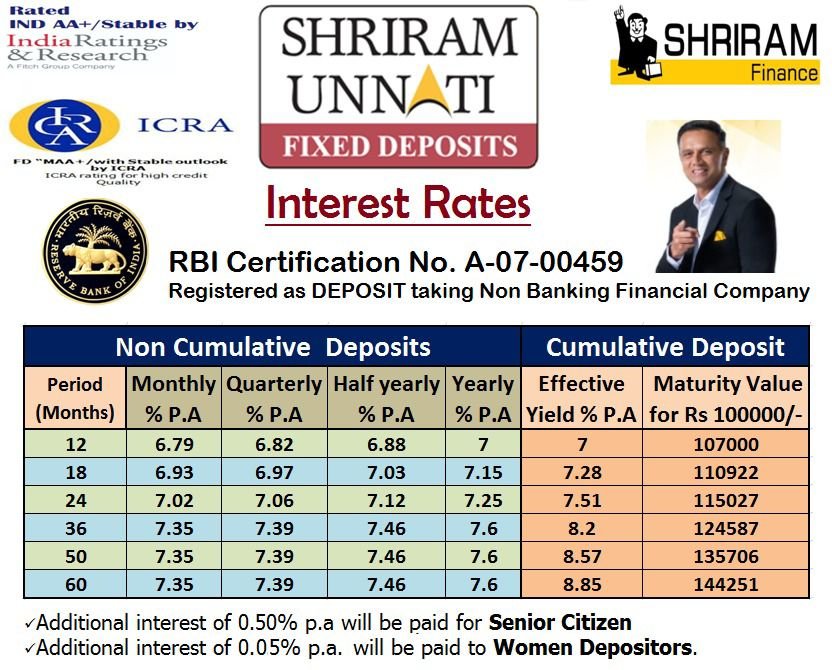

FIXED DEPOSITS:

A Fixed Deposit (FD) is a popular investment tool offered by banks and financial institutions, where you deposit a lump sum amount for a fixed tenure at a predetermined interest rate. It is considered one of the safest investment options as it provides assured returns and is not influenced by market fluctuations.

Key Features of Fixed Deposit

- Fixed Tenure:

- The duration of an FD ranges from 12 months to 60 months .

- You can choose the tenure as per your financial goals.

- Guaranteed Returns:

- The interest rate is fixed at the time of deposit and does not change, ensuring predictable returns.

- Interest Rate:

- Generally higher than a regular savings account.

- Senior citizens get extra 0.50% & Women 0.10% on fixed Interest rate.

- Interest Payout Options:

- Cumulative: Interest is compounded and paid at maturity.

- Non-Cumulative: Interest is paid periodically (monthly, quarterly, half yearly or annually).

- Taxability:

- Interest earned is taxable under “Income from Other Sources.”

- TDS (Tax Deducted at Source) is applicable if interest exceeds ₹40,000 (₹50,000 for senior citizens) in a financial year.

Advantages of Fixed Deposit

- Risk-Free Investment: No market risks, ensuring capital safety.

- Flexible Tenures: Choose tenure based on your financial needs.

- Liquidity: Easily liquidated, although premature withdrawal may involve penalties.

- Higher Interest for Seniors & Woman: Better returns for senior citizens & women.

SHRIRAM UNNATI FIXED DEPOSIT

Whether you’re planning for your child’s education, your retirement, or simply looking to grow your savings, Shriram unnati fixed Deposit provides a secure and reliable pathway to financial success.

- Investing in shriram unnati fixed deposit lets investors get up to 9.40%* p.a., (including an additional interest benefit of 0.50%* p.a. for senior citizens and 0.10%* p.a. for women depositors). Shriram fixed Deposit ensures a smooth and customer-centric investment experience, thereby making it a lucrative option for securing your financial future

- With a minimum deposit of just ₹5,000 and an easy online application process, Shriram fixed Deposit is both convenient and accessible for all investors.